Contact us

Our team would love to hear from you.

A technology enabler to automate orders execution for multiple brokers based on well-thought-out and thoroughly tested algorithms.

A privately held trading software company offers technical analysis, trading strategies, initiatives and business opportunities to brokers, private investors, family trusts, financial houses and hedge funds.

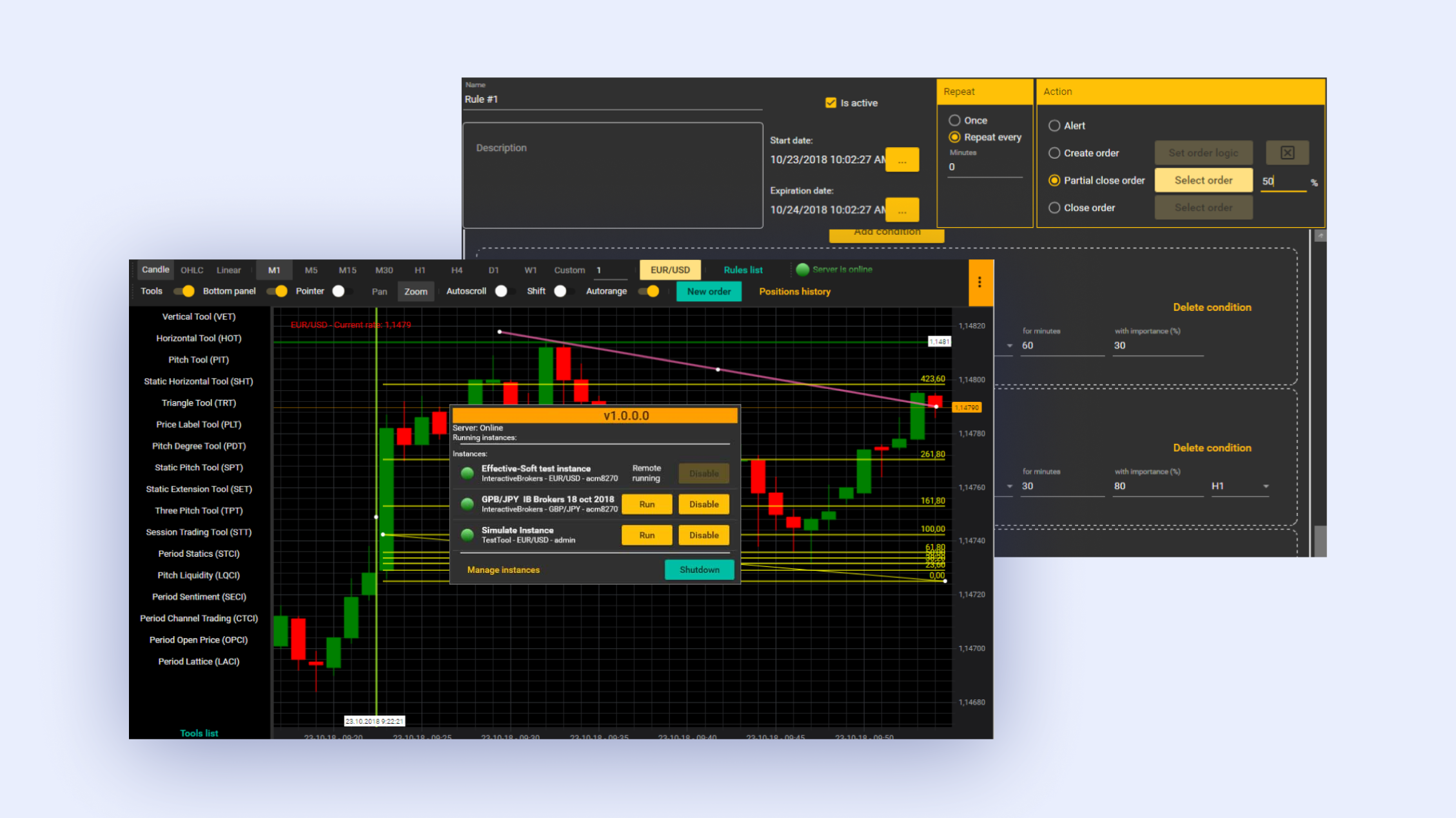

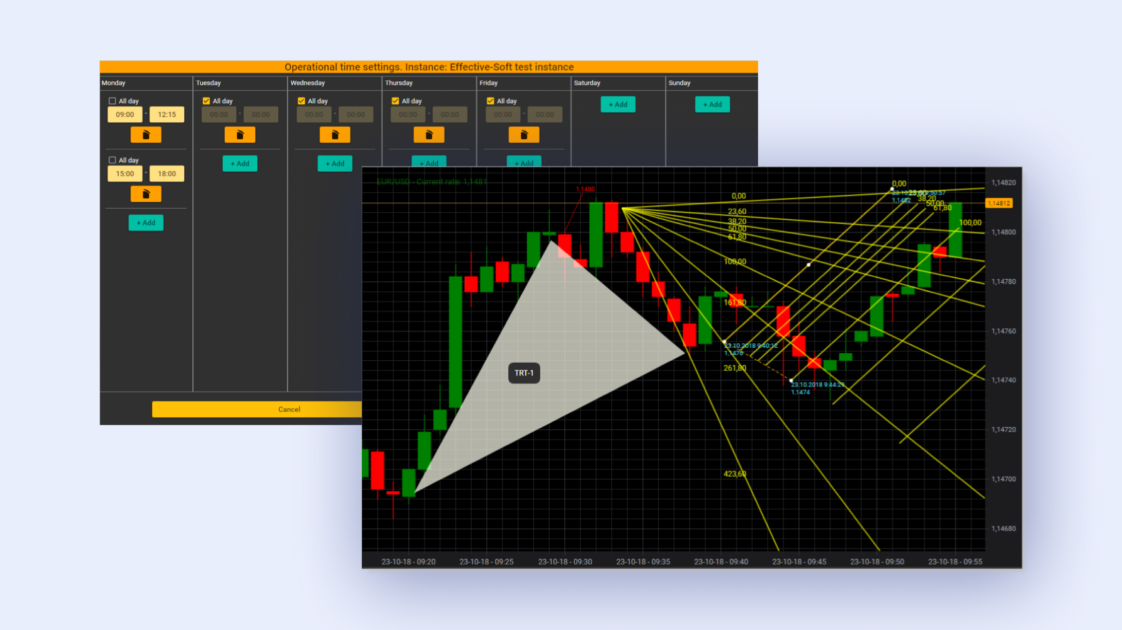

Having obtained a solid experience in mathematical modeling and trading over the years, the client was eager to have a second-to-none application for automated trading on the Forex market. The solution had to incorporate clients’ proprietary algorithms and enable users to apply rules for automated execution of trading orders.

Our tech-savvy team took up the challenge. We went through business analysis, design, from-scratch development, back- and performance testing. Shortly, the customer received the first tangible results.

The application is a Windows-based client-server solution. The server part is hosted on Windows Azure to enable scalability, performance and high responsiveness. To ensure correct trading behavior in a live market, we also developed a dedicated tool for data emulation and testing.

The solution currently supports such brokers as Interactive Brokers and Global Prime. The work goes on up to now, and more brokers are to be added.

Our team would love to hear from you.

Fill out the form to receive a free consultation and explore how we can assist you and your business.

What happens next?