Contact us

Our team would love to hear from you.

Behind the scenes, brokers operate one of three order execution models — the market-making A-Book, no-deal-risk B-Book, or hybrid C-Book approach. Understanding how each works is key to finding an optimal match based on factors including transparency, liquidity access, and risk tolerance. This article covers the core characteristics and tradeoffs of each model. Read on to discover which strategy works best and which to avoid at all costs.

To provide you with background information, we present a high-level overview of the Forex trading scheme. This typically involves an investment manager or trading platform acting on behalf of the investor, buying and selling currencies on the foreign exchange market. The investor opens an account through the investment manager or trading platform and deposits funds, which are then utilized for trading currency pairs on the Forex market.

The paragraph above touches on the involvement of investment managers or trading platforms, but it overlooks a significant link in the chain — the brokers who facilitate access to the market for individuals and institutional clients, providing trading software, leverage options, and different account types tailored to different trading strategies and capital sizes.

Understanding the predominant brokerage types is essential for selecting a partner that aligns with your trading goals and risk tolerance.

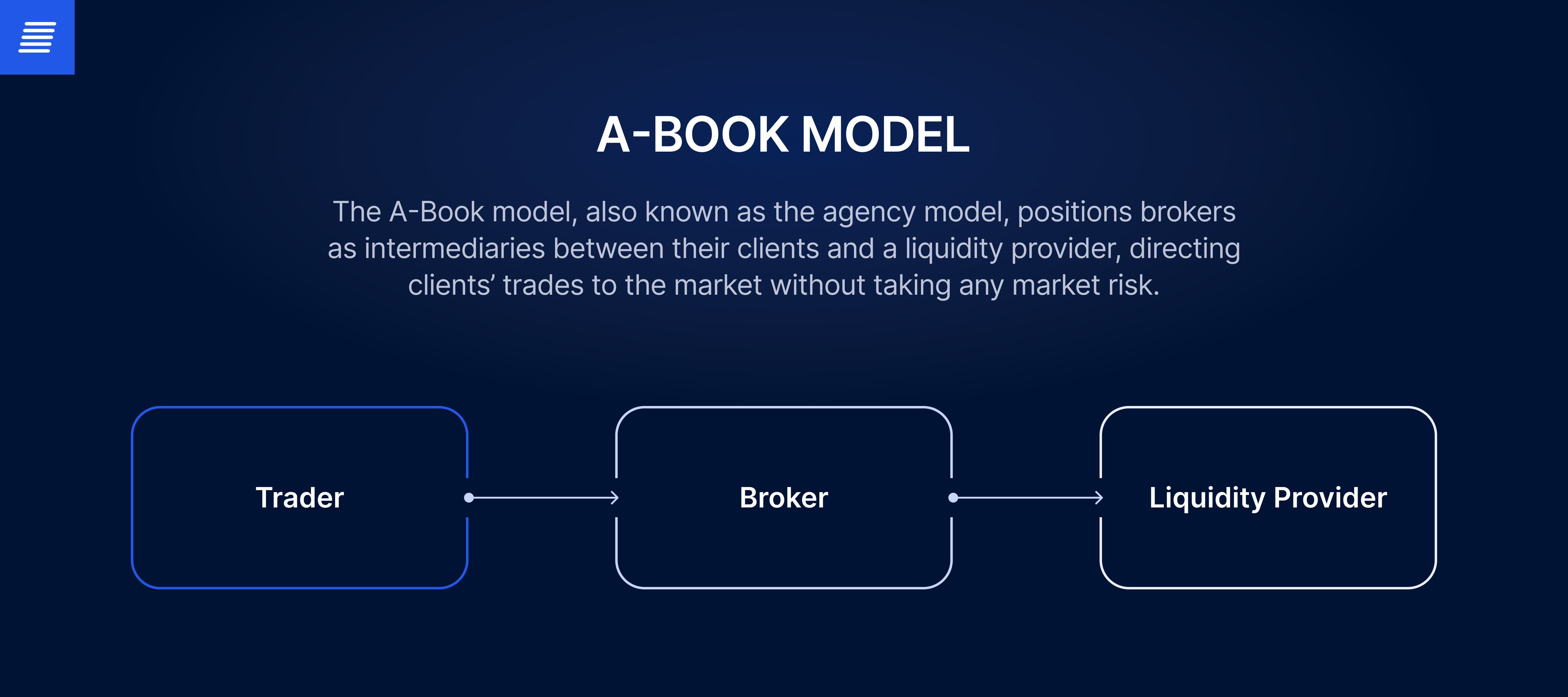

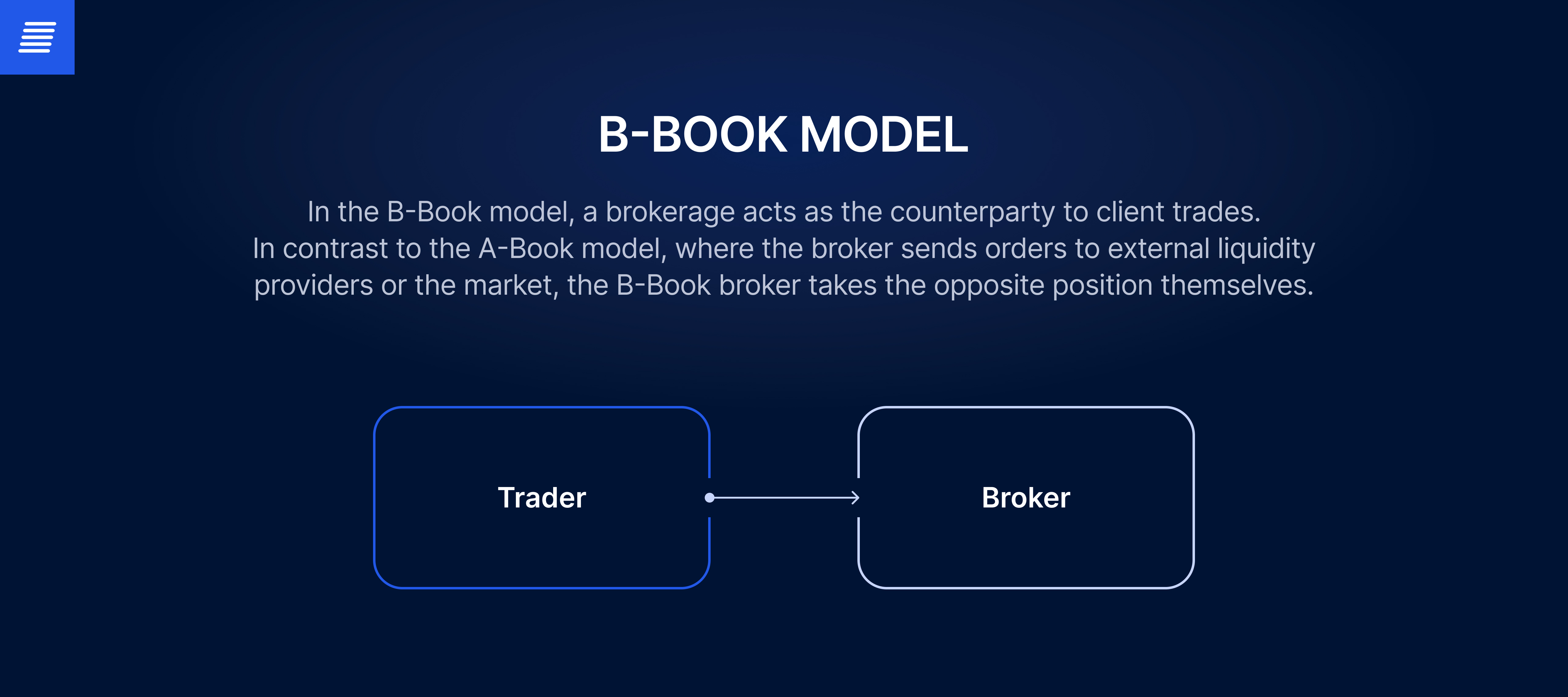

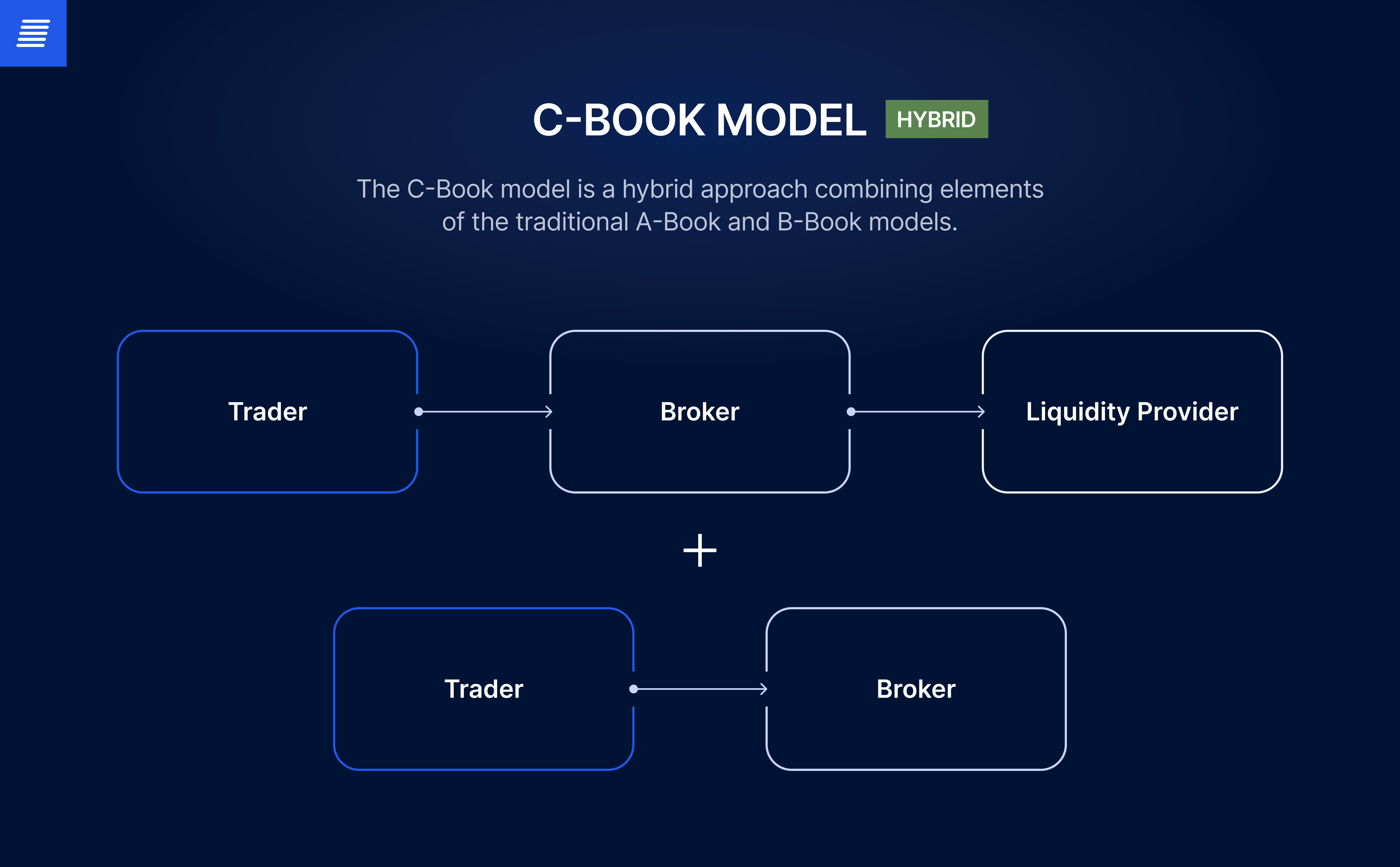

Brokers employ various approaches to facilitate trading and market making. The approach adopted significantly impacts factors such as cost structure, execution methods, and risk framework. The three primary brokerage models are A-Book, B-Book, and C-Book.

To be more specific, when a client places an order, the broker immediately offsets that position in the market, ensuring that there is no direct influence on the outcome of the trade. This means that the broker does not profit from their losses or suffer losses from their gains. Instead, the broker earns revenue through spreads, commissions, or transaction fees. Since the broker’s interest is aligned with that of the client, any conflict of interest between the broker and their clients is eliminated.The broker benefits from client trading volume, not client losses. Such transparency fosters trust between the broker and the trader.

From a revenue perspective, the A-Book model can lead to more stable and predictable income streams for the brokerage as it avoids direct exposure to market volatility. However, it’s important to note that it also creates certain risks. For example, brokers operating on an A-Book model may face challenges related to liquidity management during high volatility periods or when dealing with large client orders.

For this reason, brokers utilizing an A-Book model deploy a range of risk management strategies to mitigate operational and execution risks, rather than direct market risks from client trades. They maintain relationships with a variety of liquidity providers to ensure seamless execution, even in volatile markets, and leverage robust technological infrastructure to facilitate real-time trade processing and minimize system-related failures.

Overall, A-Book brokers strive to align client interests with their own, fostering a transparent and trust-based trading environment.

In this scenario, when a client buys a currency pair, the broker sells it to them, and if the client sells, the broker essentially buys it, all without executing the trade in the market. In this model, the broker’s revenue comes from trading spreads and potentially from the clients’ trading losses.

Since the broker’s interests are directly opposed to those of their clients, this model creates an inherent conflict of interest. However, regulations require that B-Book brokers adhere to fair practices, and are prohibited from manipulating market prices or trading conditions to cause client losses.

To balance potential exposure to risks, brokers operating a B-Book model often employ risk management strategies. They may hedge certain trades or exposure by offsetting them in the real market, or they may use statistical methods to manage the overall risk of their B-Book portfolio. This can protect the brokerage from significant market events that could lead to large client gains and corresponding broker losses.

Regulatory scrutiny of the B-Book model is indeed stringent to prevent potential conflicts of interest from resulting in unfair trading practices. Regulators in various jurisdictions have established rules to maintain broker integrity, such as requiring brokers to adhere to best execution practices, segregate client funds, and offer transparent pricing.

To uphold their reputation and maintain client trust, brokers using this model must exercise careful risk management and maintain a high level of transparency.

iOS, Android, and web apps allow trading stocks, crypto, futures, ETFs, and Forex pairs at real-time spot prices.

It aims to balance the characteristics of both A and B models depending on the situation, with brokers able to combine market making and order matching. In the C-Book model, when clients want to trade less-popular or low-liquidity currency pairs, the broker operates under the A-Book model, taking on temporary risk. However, for larger or more actively traded pairs, brokers simply match client orders like the B-Book brokers do.

This strategy allows brokers to offer their clients competitive pricing on less liquid instruments while avoiding risk on popular currency pairs with high volumes. By collaborating with brokers utilizing the C-Book model, traders gain access to both market making and no-dealing services from a single broker, which can result in better pricing and more liquidity. However, these brokers also require attention since traders may not always know whether they are receiving the best available price or if the broker is taking on risk themselves.

Now that we’ve done a quick review of all 3 models, let’s compare them based on their distinctive features.

From the broker’s side:

From the trader’s side:

From the broker’s side:

From the trader’s side:

From the broker’s side:

From the trader’s side:

Given the global, decentralized nature of the Forex market, brokers operate in a complex regulatory environment subject to a complex array of regulations that vary depending on jurisdiction. Below, we provide the regulatory specifics based on the brokerage model selected.

A-Book brokers are regulated more stringently as Multilateral Trading Facilities (MTFs) or Electronic Communications Networks (ECNs) in jurisdictions like the United States, United Kingdom, Europe, Australia, and Japan. Key regulations include:

The A-Book model is considered less risky for clients since the broker cannot trade against them. But spreads may be wider compared to B-Book due to the straight pass-through of external liquidity pricing.

B-Book brokers face less stringent regulatory oversight compared to A-Book brokers. Certain jurisdictions like Cyprus, Mauritius, and the Caribbean have attracted B-Book brokers due to more flexible requirements around registration, capitalization, and reporting. However, the B-Book model poses ethical concerns around transparency and potential conflicts of interest:

Routing certain clients or trade types through their own book while sending others to liquidity providers allows C-Book brokers to balance revenue generation and ethical considerations.

Regulations continue to evolve globally around retail Forex practices. However, transparency remains a concern as traders may be uncertain whether they are receiving genuine interbank pricing or if the broker is taking the opposite position. Traders should research a broker’s structure and regulatory jurisdiction before opening an account.

Selecting the most suitable brokerage business model is a pivotal decision that is tied to your operational strategy. These insights will help you navigate the decision-making process.

Understanding who your clients are will significantly influence the model that best suits your brokerage. For new traders, the simplicity of a B-Book model may be sufficient, while advanced investors might require the sophistication of the A-Book model. Evaluate the trading behavior, asset preferences, and location of your client base. Surveys can help obtain direct insights into their expectations and requirements.

Your growth strategy should align with your brokerage model. If you’re aiming for rapid expansion, the A-Book model is a viable option. For brokerages aiming to balance their own risk with growth, B-Book might be a more compelling model. C-Book caters to the personalized needs of VIP clients.

Efficiently managing your B-Book trades depends on your access to liquidity. For a C-Book approach, the ability to negotiate customized liquidity solutions with banks is essential. Consider the costs and complexities of integrating with various liquidity providers.

Compliance is non-negotiable. Each model has regulatory obligations, from client fund segregation to reporting standards. Understand the implications of each model in the jurisdictions where you intend to operate.

Both the B-Book and C-Book models demand a strong risk management infrastructure in terms of both technology and expertise. Assess your team’s capabilities before committing to a model.

Each model presents its own set of advantages and challenges. The key to selecting the right model for your brokerage is to define your business’s priorities and align them with the most fitting operational structure.

Selecting the right model for your brokerage is a strategic decision that must be aligned with your appetite for risk, technological capability, and ethics. While the A-Book model focuses on transparency and client alignment, the B-Book model can offer greater profit opportunities along with increased risk. The C-Book balances risk and reward by combining the A and B models.

Ultimately, the choice depends on your business goals, market understanding, and clients you serve. By carefully weighing the pros and cons of each model and understanding the demands of your trading environment, your brokerage can create an operational approach that ensures sustainability, profitability, and client satisfaction. Contact us to reap the benefits of our 20+ years of experience in building advanced solutions for various businesses in the financial sector.

Our team would love to hear from you.

Fill out the form to receive a consultation and explore how we can assist you and your business.

What happens next?