Contact us

Our team would love to hear from you.

Big data analytics is the main source of actionable information for enterprises. It provides customer insights, ensures a better understanding of the market, facilitates decision-making, enables data-driven innovations, helps improve business operations, and much more. Financial institutions are at the forefront of adopting and utilizing big data solutions. According to Mordor Intelligence, the market for big data analytics in banking is projected to grow from $8.58 million in 2024 to $24.28 million by 2029.

Source: Mordor Intelligence

In this article, we’ll explore the role of big data in finance and outline its benefits for financial institutions. We will also address the challenges of using big data in financial services and highlight specific use cases and real-world examples.

Big data is the term used to describe very large sets of structured, semi-structured, and unstructured data that rapidly and continuously grow over time and therefore can’t be processed manually or by traditional data processing solutions. In finance, this data is produced daily by financial institutions and includes market data, customer information, client transactions, social media activity, and more. The primary value of this data lies in the insights gained through collection, processing, and analysis using specialized advanced software.

As in other spheres, big data in finance is characterized by four Vs:

The implementation of big data analytics is key to maintaining a competitive edge in the financial sphere. Institutions that effectively harness big data will excel in addressing today’s financial challenges and deliver greater value to stakeholders.

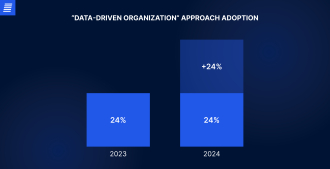

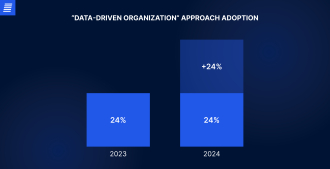

According to G2, 48% of companies established a “data-driven organization” in 2024, compared to 24% of enterprises surveyed in 2023. This indicates that numerous enterprises see significant advantages in working with big data.

Big data solutions significantly enhance decision-making by performing comprehensive data analytics. These analytics allows financial companies to identify trends and patterns in customer behavior and use this information to forecast future results and adjust their strategies and operations accordingly.

Big data analytics has significantly transformed customer experience. Analyzing transaction histories, spending patterns, and even social media activities gives financial institutions a deep understanding of their clientele. This insight allows for hyper-personalized services, tailored product recommendations, and proactive customer support. By anticipating customer needs and preferences, banks and other financial organizations can build stronger relationships with their clients.

Big data analytics tools can identify unprofitable branches and initiatives, helping financial enterprises boost efficiency. In addition, big data analytics solutions can automate processes such as fraud detection, credit scoring, customer segmentation, and feedback analysis, speeding up operations and saving resources.

Due to factors like data collection challenges, storage issues, and lack of standardization, data collected by financial services providers often contain errors. Big data solutions typically include automated data cleansing features that identify and correct mistakes, including duplicate entries, missing values, formatting inconsistencies, and more. This ensures that enterprises obtain accurate big data analysis results and can effectively apply them.

Despite its vast potential, big data analytics offers limited benefits to financial businesses if certain challenges are not overcome.

Financial institutions have large volumes of data scattered across various systems. This creates data silos, which can prevent comprehensive analysis. Addressing this issue requires a multilayered approach that includes creating centralized data repositories, standardizing data formats, and establishing data governance frameworks.

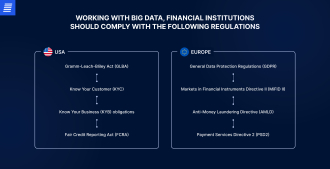

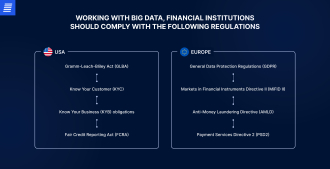

Big data in financial companies involves handling large volumes of sensitive information, which raises privacy and security concerns and makes robust data protection measures essential. Ensuring data security and privacy requires implementing robust security protocols, encrypting data during transmission, establishing access control, adopting a data governance framework, and other measures. Furthermore, due to the sensitive nature of the data handled by financial organizations, the sector must adhere to numerous data protection laws. Compliance with these regulations is crucial for maintaining consumer trust, managing risks, preventing fraud, preserving individual privacy, and guaranteeing market integrity.

Once a big data tool has completed the entire process — including data collection, storage, preprocessing, format standardization, processing, analysis, and result visualization — businesses can leverage the insights for various initiatives.

Financial organizations can use big data analytics to more effectively evaluate customer demand. By exploring clients’ social media activity, transaction history, and online interactions, financial institutions can gain deeper insights into customer behavior, preferences, and needs and tailor lending alternatives, insurance plans, communications, customer service, and investment possibilities accordingly.

Big data analytics is crucial for customer segmentation, allowing organizations to categorize customers based on various criteria, including behavior, needs, preferences, and socioeconomic status. Financial services companies can use customer and group data to develop targeted marketing campaigns, products, and services tailored to each category. This approach helps improve user experience, retain clients, and reduce churn rates.

Big data analytics tools forecast future trends, risks, and opportunities in finance by leveraging both historical and real-time data. For instance, to reduce losses, financial institutions can use big data to predict market and price trends and estimate the likelihood of an economic recession. Big data also helps companies project future revenues, costs, and profitability to guide strategic planning and budgeting.

Financial institutions use credit scoring and underwriting to assess loan applications and make lending decisions. By examining credit reports, income and employment data, rent payments, usage of telecommunications services, digital footprints, and other factors, lending institutions can reduce prejudice and improve the quality of their loan decisions. Additionally, lenders can tailor credit card and loan offers to the needs of specific borrowers by leveraging the insights obtained from big data. This lowers the rate of loan default and helps lenders manage risks.

According to Statista, approximately 64% of financial institutions worldwide experienced a ransomware attack in 2023. An analytics tool allows financial institutions to collect and record every transaction, generating a large dataset for analyzing transaction trends. By identifying trends and patterns, big data technology can detect suspicious behaviors, such as unusual spending or transaction locations that may indicate fraud.

Algorithmic trading uses big data tools to analyze a broad spectrum of information, including market data, news sentiments, and economic indicators, in real or near real time. By leveraging these advanced analytics, trading algorithms can quickly identify patterns, assess risks, and execute trades with lightning speed. This allows financial institutions to capitalize on market inefficiencies and maximize profits while reducing the risk of major losses.

Analytics software tracks a company’s key performance indicators (KPIs), including sales, profit margins, expenses, cash flow, and more in real time. It also facilitates measuring staff performance indicators, analyzing sales performance, assessing satisfaction rates among employees, and more. This enables companies to identify operational problems and financial patterns while also facilitating prompt decision-making.

A centralized data warehouse and Microsoft Power BI allow collecting and analyzing data from the divisions scattered across the USA.

Big data has been extensively utilized in finance for a significant period, so there are numerous successful big data use cases to explore.

This U.S. company provides investment banking and financial services and uses big data to detect investment opportunities. To identify the best possibilities, the institution developed data-driven investment algorithms that assess thousands of businesses worldwide. This approach enables the organization to pinpoint strong enterprises and make informed decisions.

This accounting and audit enterprise needed to conduct internal audits to detect risks, mistakes, and fraud. Previously, it accomplished this by conducting multiple interviews with employees and partners, a process that was both lengthy and inefficient. The company turned to big data to ensure its investigations were quick and accurate.

JPMorgan, which offers various financial services worldwide, uses analytics tools to integrate transaction data with information from other sources to gain deeper insights and accurately assess clients’ creditworthiness. The company also uses big data technologies to detect patterns in client behavior, helping identify potential revenue opportunities and market risks.

This U.S.-based financial services company turned to big data to improve business operations and customer service. The organization has assembled a Tableau-powered team that gathers, aggregates, cleans, and organizes data from 70 million consumers to conduct its data analytics process. As a result, Wells Fargo and Company has enhanced customer experience and boosted revenue creation by improving risk management, customization, and segmentation.

Although big data is a complex initiative requiring careful integration and thoughtful application, big data utilization has significantly improved the quality of financial services. Numerous institutions worldwide, including major players, integrate big data analytics tools to obtain valuable insights. Advanced analytical techniques and machine learning algorithms help businesses identify patterns, optimize company operations, conserve resources, and increase profits. If you are looking for reliable big data software analytics developers for your financial organization, contact EffectiveSoft.

Big data systems provide banks with extensive analytics capabilities, enabling them to process, organize, and extract valuable information. By leveraging this data, companies can better understand their customers’ needs, develop more effective marketing strategies, and offer tailored product suggestions to enhance customer satisfaction. Big data analytics software also helps banks identify fraud and reduce financial losses. It also saves resources by automating manual procedures, locating underperforming branches, and increasing productivity in various business aspects.

Privacy concerns are a major challenge facing the finance sector in the realm of big data. As financial organizations manage vast amounts of personal and financial data, they must be especially vigilant in protecting it. Another problem is data silos: financial institutions store vast amounts of data in various systems, making it challenging to access and assess. Approaches to addressing this issue include standardizing the data formats used throughout the company or developing centralized data systems. The third challenge is regulatory compliance. The financial industry is regulated by multiple laws that must be meticulously followed.

Using big data, financial institutions can examine clients’ transaction histories, social media activity, demographics, economic patterns, and more. Using the gathered information, companies can offer personalized loan options, insurance policies, client support, and investment opportunities, among other things. In addition, big data analytics helps with client segmentation based on a variety of factors, including behavior, needs, preferences, and socioeconomic status. It can be used to assign consumer groups and develop customized marketing campaigns, goods, and services for each category, improving user experience, retaining customers, and decreasing abandonment rates.

Can’t find the answer you are looking for?

Contact us and we will get in touch with you shortly.

Our team would love to hear from you.

Fill out the form to receive a consultation and explore how we can assist you and your business.

What happens next?