Contact us

Our team would love to hear from you.

But what does digital transformation look like in the financial services industry? Read on to learn how it can benefit your company, some common challenges, and the top trends.

In finance, digital transformation means rethinking the way companies in the financial services industry (FSI) (e.g., banking, investment, insurance, tax and accounting companies, real estate) use technology. The main idea of finance business transformation revolves around the demands of the target audience. In the effort to win customers’ loyalty and improve customer satisfaction, companies need to rebuild processes, modify culture, and create new ways of interacting with consumers based on technological advances.

Digital transformation can sometimes be referred to as digitalization or digitization in financial services. However, digital transformation is more than those two processes. It involves creating a different business model for FSI firms, incorporating a new strategy, structure, and governance based on the integration of emerging technologies. Meanwhile, digitization (making analog information digital) is only a part of the process that goes under the name of digitalization (making processes digital), which, in turn, is a part of digital transformation.

Financial services companies that embrace digital transformation gain advantages over industry competition.

Digital transformation implies automating manual tasks, which eliminates repetitive and redundant procedures and streamlines processes. This helps significantly reduce the time and resources required to implement these procedures and can be used to work on other tasks that are important for achieving a company’s goals.

Financial services businesses are driven by data. They also base their decisions on customer behavior in the market. Digital transformation makes collecting and managing data easy by automating these processes, allowing companies to efficiently gather and structure information and use it for further analysis.

Resulting from data management, financial services transformation helps companies take advantage of collected data and improve analytical processes using digital technology. Artificial intelligence (AI), machine learning (ML), advanced analytics, and other breakthrough technologies can be applied to gain meaningful and accurate insights from big datasets.

The customer is the driving force behind change and innovation, as any business strives to make the experience of its target audience as pleasant and engaging as possible. Analysis of all the data that is collected through user engagement helps improve the way a company communicates with its audience and increases customer involvement.

One of the key components of the digital transformation of financial services is agility and flexibility. Companies that go digital are always on top of change, constantly adopt innovations, follow the latest trends, continuously evolve, experiment, and learn. Enhanced processes increase productivity and eliminate many errors and risks.

However, in the pursuit of digital innovation, companies may neglect some risks that can be eliminated with a proper approach to this process.

Insufficient training and lack of skills and knowledge can be a significant obstacle to digital transformation. New processes and technological innovations can be hard to follow, especially for companies with a well-established workflow that would be transformed when stepping into the digital world. That’s why it is important to support and educate employees through this journey.

The way digital transformation goes is also impacted by the partners that your organization chooses. The company of choice should be experienced in the industry and able to provide robust solutions, integrating them with the latest technologies.

Digital transformation is more than just technology adoption, and not all companies consider that they need to completely remodel their structure, enlighten their staff, and take many other significant steps. Strong governance can be a challenge for FSI firms that approach digital transformation without preparation and implementation strategy. This challenge can be conquered with relevant expertise and proper planning.

One of the biggest priorities that FSI firms have is security and privacy of data due to the sensitive nature of financial procedures. Cyberattacks are a major concern when it comes to digital assets and transactions. Companies should focus on detection of breaches, potential risks, response procedures, and defense systems to prevent security threats. In terms of digital transformation in financial services, compliance and regulations are also a priority that should be considered when managing security.

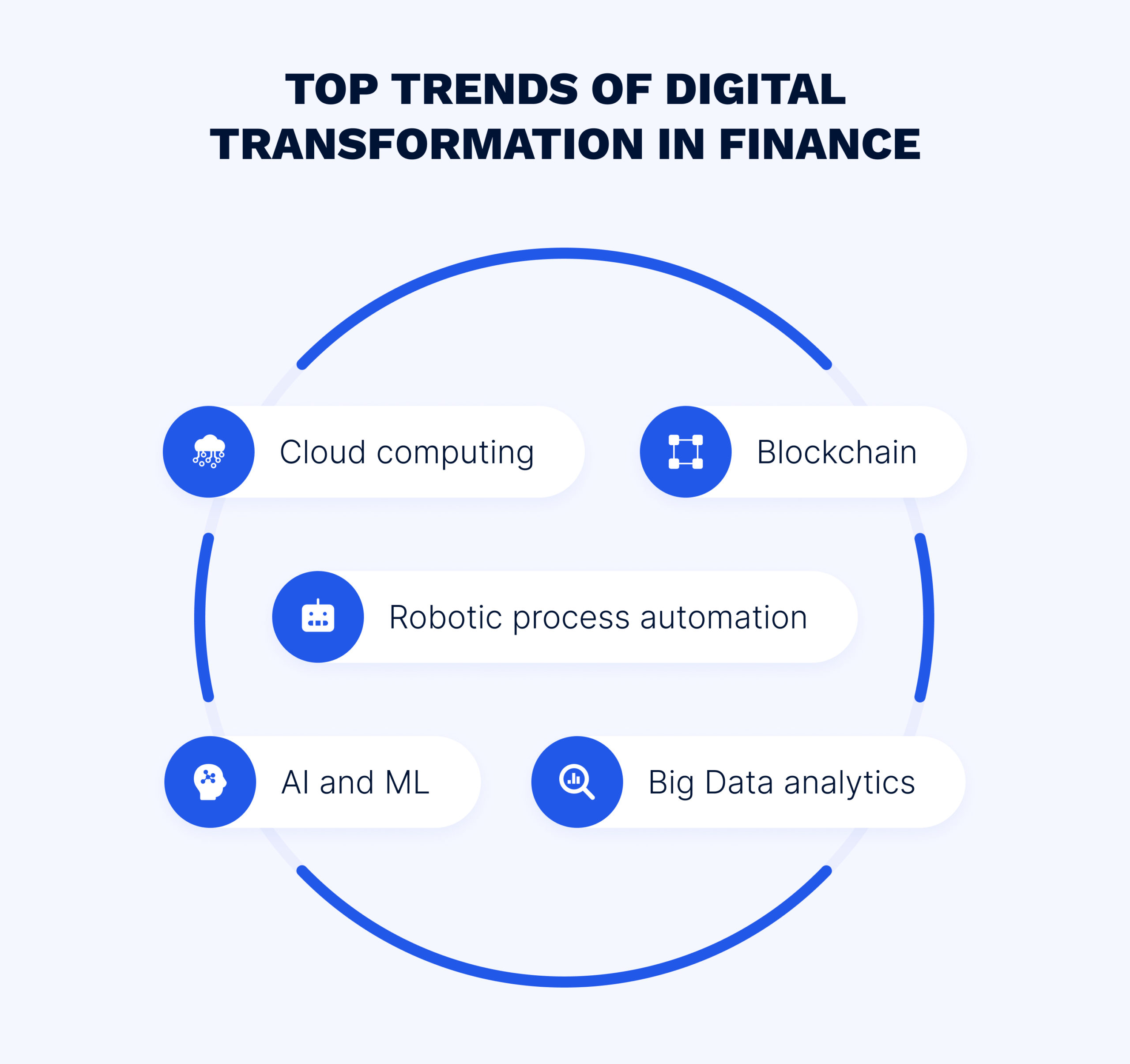

Following are some digital transformation trends in financial services that FSI companies will find useful.

More and more financial organizations are moving to cloud platforms. Cloud is expected to become the platform of choice for more than 95% of new digital initiatives by 2025, as compared to less than 40% in 2021.

Some of the main advantages of this technology are transparency and control, giving companies access to all the data in real time. Turning to the cloud does not require spending resources on hardware, software, maintenance, and other expenses.

The only concern that may arise is security and privacy compliance, though the development of this technology allows for enhanced control of private data.

Blockchain is the future of fast and secure transactions, making it an invaluable technology for financial services. Payment systems are already used by tech-savvy financial companies, as these tools provide quick and easily traceable financial transactions.

Smart contracts are some of the most beneficial applications of blockchain in finance, as they help automate the execution of agreements without the involvement of intermediaries, updating and notifying the parties when transactions are completed. Smart contracts are transparent and quick, with enhanced security due to record encryption.

Adoption of AI and ML is becoming more prevalent in financial services app development, with many application cases such as AI-enabled data analytics, fraud detection, surveillance, risk management, AI-enabled customer communication channels, and revenue generation.

Increased customer satisfaction through personalization based on customer profiles, time optimization through automation, enhanced analytics, and informed decisions are the benefits that AI and ML give to FSI firms.

FSI firms are constantly looking for new ways to employ all the large and complex datasets that they harness in order to transform internal and external processes, improve decision making, and personalize their services. ML-based Big Data processing can be used to evaluate risks, analyze financial markets and customer behavior, monitor stock market trends, and more.

However, the potential of Big Data can be hard to fully exploit without developing a strategy and ensuring that a company’s employees use the technology efficiently. There’s also a possibility of creating data silos without proper management.

RPA is designed for executing repetitive tasks to speed up and improve the accuracy of simple processes, eliminating human-induced errors. Nowadays, RPA solutions are used by around 80% of finance companies. AI and ML integration is also a common option, making it easier for these systems to find patterns in data, predict outcomes, learn from data and experience, and trail potential issues.

In finance, RPA can be applied to detect fraud, categorize customer information and automatically distribute it among necessary departments and specialists, send notifications, implement simple tasks connected to customer service, and more.

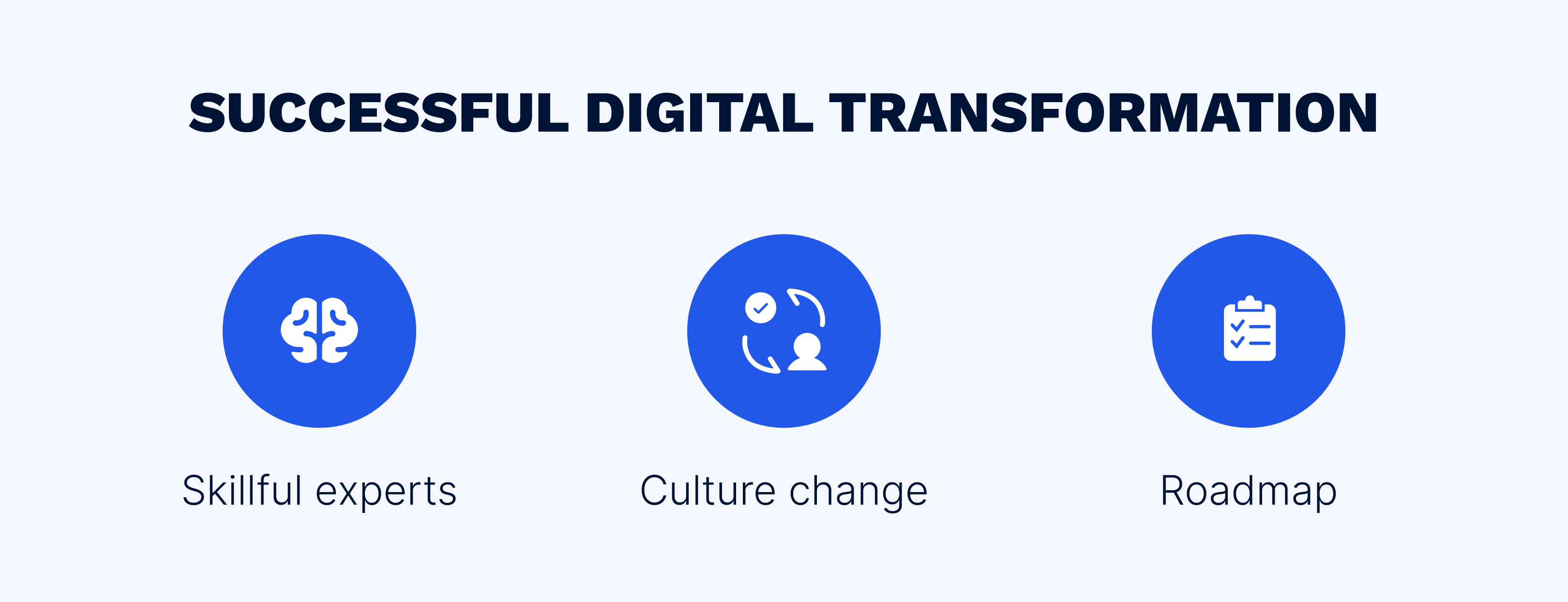

Changing the way a company works can be difficult, especially for businesses that rely on traditional processes. That’s why a clear and comprehensive digital strategy and thorough planning are essential for successful digital transformation.

Skillful experts. The choice of digital transformation partners, from consultants to system integrators, should be in alignment with a company’s goals, vision, and values.

Culture change. Training and supporting employees during the whole digital transformation should be a priority, as motivated people eagerly accept change.

Roadmap. This involves setting goals, describing expected outcomes, choosing relevant technology opportunities to invest into, scheduling, establishing milestones, and monitoring progress.

The world is changing and technology is taking over a great part of our daily activities. At present, we have gadgets and applications for every aspect of life. That’s why companies must be one step ahead and provide solutions that are going to satisfy customer needs. By adopting an effective digital transformation strategy, financial services companies can gain a competitive advantage, engaged customers, and motivated employees. Partnering up with a company experienced in financial technology is a great way to start.

Contact us to learn more and find out how we can help you on your digital transformation journey.

Our team would love to hear from you.

Fill out the form to receive a consultation and explore how we can assist you and your business.

What happens next?