Contact us

Our team would love to hear from you.

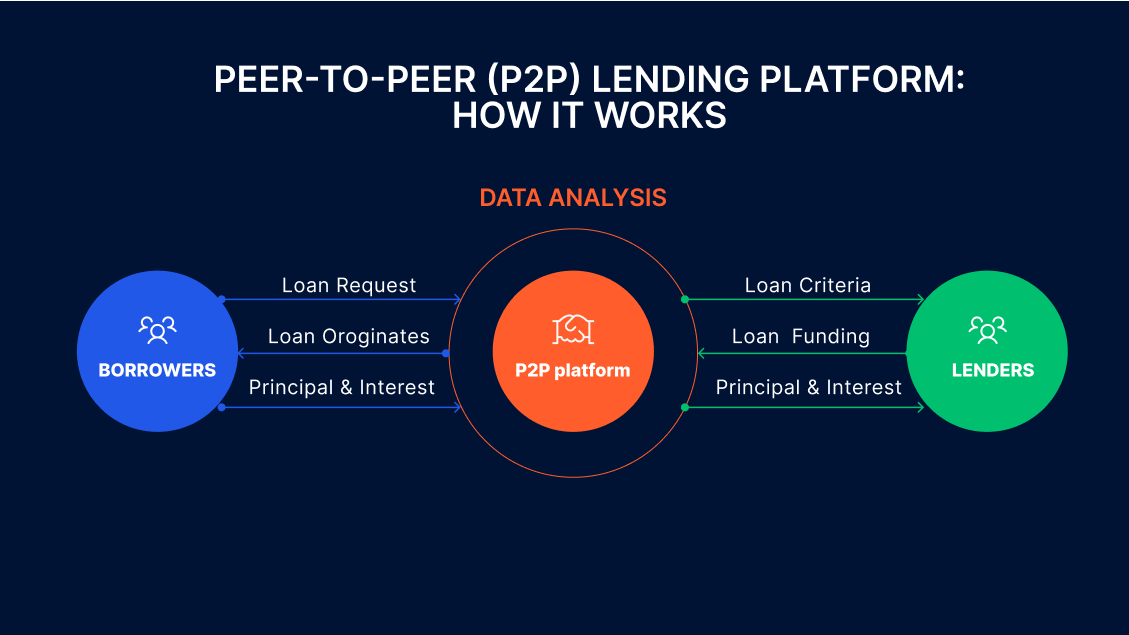

The web application helps investors get higher returns on capital, whereas borrowers can get better loan rates cutting out the traditional ‘middleman.’

The client turned to EffectiveSoft to create an ethical peer-to-peer (P2P) platform bringing individual private investors and borrowers together, with no legal entities or financial intermediaries involved. The returns from the platform for investors were expected to beat most savings accounts, bonds, etc., thanks to higher interest rates, with no added charges.

Our client needed an easy-to-navigate web application that keeps track of investments or borrowings and provides information on planning and managing finances.

Peer-to-peer (P2P) platform

Symfony2, JQuery (+plugins), Twitter Bootstrap, third-party APIs

We provided web application development services that met all the client’s requirements as it:

The specialists at EffeciveSoft used HTML5 and JQuery library to build the application frontend. The backend is LAMP-based with the CodeIgniter framework and the CI Validation. As a protocol between the backend and frontend, the JSON was used. Besides, the web application is compatible with all the commonly used Internet browsers.

During the development process, the team at EffectiveSoft was working in close liaison with the client. Following the agile approach, we were able to implement incremental, feedback-driven changes to the platform. The team proactively added lots of new features and improved the design and aesthetics of the final product. Thus, when we completed the project, the results greatly exceeded the original expectations.

On top of that, the client agreed to serve as a reference account for EffectiveSoft.

Our team would love to hear from you.

Fill out the form to receive a consultation and explore how we can assist you and your business.

What happens next?