Contact us

Our team would love to hear from you.

Slow transactions, limited payment options, or compliance gaps cause your clients to drop purchases at checkout, create failed settlements, and expose your business to regulatory penalties.

We address these challenges with payment gateway integration and payment processing software development. Our solutions support multiple payment methods and currencies, ensuring a smooth and secure checkout experience for your clients while meeting the latest regulatory standards, like PCI DSS and AML

Solutions

If you need to connect your internal systems to third-party gateways or switch to a more reliable integration partner, our expert software developers are at your disposal. EffectiveSoft’s team integrates web, mobile, and point-of-sale (POS) systems with trusted payment gateways like Stripe, Adyen, PayPal, and local banks. Based on your geography, industry-specific regulations, and internal policies, we select the most effective option for your business model. For companies operating in multiple regions, we implement smart routing, so transactions go through the provider with the highest chance of success.

When billing logic is complex, transactions are routed across several providers, or branded checkout flows are needed, a direct payment gateway integration is usually not enough. That’s when we suggest developing a custom app that sits inside your ecosystems. These solutions handle necessary subscriptions and commissions, provide a branded user interface (UI), ensure compliance with industry-specific regulations, and connect payment options with the systems you already use.

Buy Now, Pay Later (BNPL) is rapidly expanding, improving the buying experience for customers who prefer splitting payments into installments, allowing them to make purchases they might otherwise have been unable to afford. In turn, businesses see higher conversion rates, larger average orders, and better customer retention.

We integrate trusted BNPL models into the existing enterprise ecosystem, ensuring seamless data flow and sync between platforms. Our approach includes secure data handling and compliance with financial regulations like PCI DSS, KYC, and AML, giving our clients a reliable payment option that drives revenue.

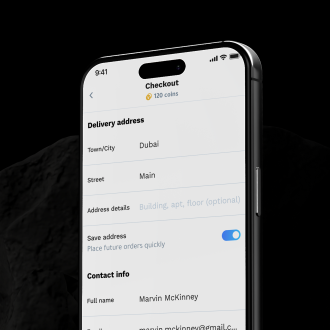

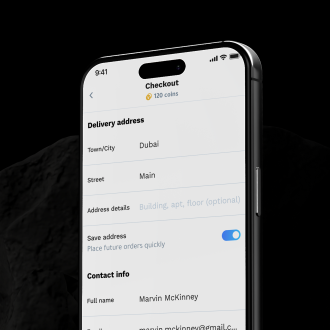

Mobile wallets have become a standard payment option. Customers don’t need to carry cash or enter card credentials each time they make a purchase. For businesses, this means faster checkouts, fewer abandoned payments, better flexibility, and improved loyalty from users who prefer tools like Apple Pay, Google Pay, or Samsung Pay.

At EffectiveSoft, we integrate mobile payments to help companies securely process high transaction volumes and stay compliant with domain-specific standards. We also ensure a consistent payment experience across devices, so customers can make purchases quickly and with confidence.

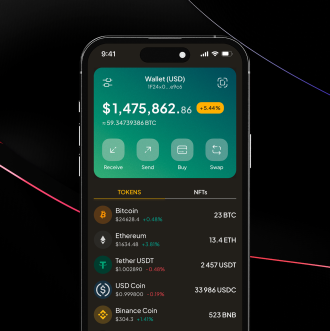

Cryptocurrencies enable near-instant cross-border payments and in some cases lower transaction fees. Since every transaction is stored in an immutable ledger, the risk of fraud is reduced while privacy and transparency are improved. For businesses, this means not only cost efficiency but also access to customer segments that prefer to pay with crypto, without intermediaries.

In our crypto payment gateway development company, we enable organizations to accept a broad range of digital currencies like Bitcoin, Ethereum, and USDT. Our solutions are engineered for seamless integration with your existing workflows.

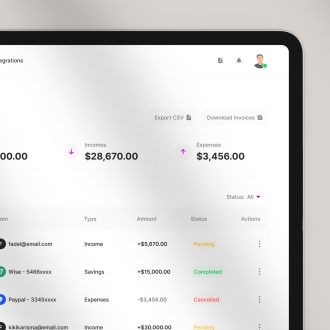

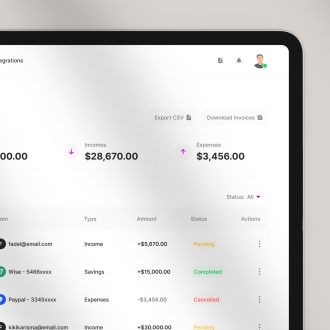

Manual invoicing management and payment collection often leads to errors, delays, and higher operational costs. To address these challenges, we automate the process of invoice generation, billing, and payment acceptance. We develop bespoke solutions that enable companies to customize discounts and payment terms, generate invoices in multiple currencies, and adapt formats to the legal and accounting standards of the country where they operate. As a result, every issued invoice and received payment is tracked instantly, providing businesses with real-time visibility into cash flow, reducing overdue accounts, and accelerating settlements.

Peer-to-peer (P2P) lending software directly connects private investors with borrowers, removing intermediaries and automating the whole lending process. This usually means lower interest rates, faster and more convenient funding, more lending opportunities, and flexible terms.

At EffectiveSoft, we build P2P platforms that include custom business logic, risk-mitigation mechanisms, excellent user experience (UX), and a secure, transparent environment.

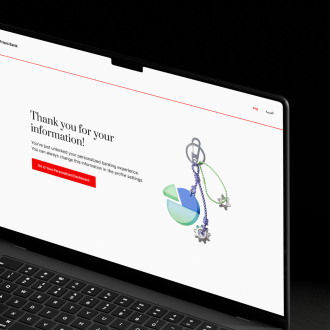

We integrate software solutions with leading Open Banking providers like Plaid, Itexus, and TrueLayer, ensuring support for OAuth 2.0 authorization, secure consent flows, and safe data exchange. This gives businesses secure access to account balances, transactions, and customer payment histories—all with their consent. Open Banking integration enables businesses to offer more personalized products and services, as well as detect and prevent fraud.

Our partnership is more than just development. We transform ambitions into reality, creating cutting-edge fintech solutions that become the foundation for your future growth and market leadership. Because we don’t adapt to tomorrow—we design it.

Delivery Manager

Process

During our discovery sessions, workshops, user research, and stakeholder interviews, we learn about you, your business, your business challenges, and the end users of the future solution. Those insights help us define clear requirements and build a comprehensive project road map.

Based on the predefined requirements, our engineers create a solution architecture that supports your revenue model, reflects customer experience, meets compliance needs, and scales with your future growth.

Our team maps the user journey, defines how payment flows should work, and creates intuitive, consistent interfaces for checkout, mobile payments, invoicing dashboards, and lending platforms.

Our engineers turn the designed architecture into a fully functional digital payment solution. They handle coding, configuration, and API connections to ensure every feature works as intended.

We rigorously test the payment processing solutions under real-world conditions. The QA process covers functionality, performance, and security tests. We also verify alignment with PCI DSS, PSD2, KYC, AML, GDPR, and other applicable standards to ensure your system handles sensitive financial operations with the utmost security.

When the payment software is developed and tested, we deploy it to your live environment. But our partnership doesn’t stop there. We provide continuous monitoring, updates, and improvements to keep your system secure, compliant with regulations, and aligned with market needs.

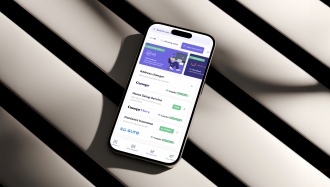

We integrated a new payment provider into the existing platform, which allowed the client to expand the market.

We built a multicomponent fintech ecosystem that turned a startup into a UK market leader.

The web application helps investors get higher returns on capital, whereas borrowers can get better loan rates cutting out the traditional ‘middleman.’

We replaced outdated infrastructure to improve efficiency and reduce operational costs.

We developed a user-friendly crypto wallet that enables crypto exchange operations on the go.

Want more?

View portfolioWhy us

Our team consists of Oracle– and Microsoft-certified engineers who ensure every solution meets the highest security and compliance standards.

We’ve delivered over 1,836 projects, including payment solutions for fintechs, e-commerce platforms, SaaS providers, and digital banks worldwide.

The market never stands still, and neither do we. We adapt our approach and process to build solutions that fit the moment and the future.

We have dev centers in multiple regions, and our portfolio includes clients from North America, Europe, and Asia. This allows us to work seamlessly across time zones while understanding local market specifics.

We believe strong partnerships are built on transparency and respect. Throughout the project lifecycle, we maintain honest and direct communication that builds lasting mutual trust.

From PCI DSS and PSD2 to KYC, AML, and GDPR, we implement best practices, anti-fraud measures, and secure architectures that protect sensitive data and keep you fully compliant.

Seeking ways to streamline checkout, expand payment capabilities, and stay compliant with global regulations? Let’s discuss how we can make it happen.

Tech Stack

We work with growth-focused companies across domains, including fintech, e-commerce, SaaS, and digital banking. If you need a custom billing flow, multi-gateway routing and payment orchestration, scalable infrastructure to handle growing transaction volumes, or modernization of legacy payment systems without compromising critical processes, you’ve come to the right place. Contact us.

Yes, we don’t disappear after the solution is launched. We provide ongoing maintenance and support to ensure your payment software stays reliable, secure, and fully aligned with compliance regulations.

Yes, to ensure your internal team can work with the solution confidently, we provide a clear overview of system architecture, API specs, access control policies, quick-start guides, and more. If required, we also support training sessions and knowledge transfer.

Yes, we replace legacy payment infrastructure or modernize it, although the latter is more complex than building from scratch. Legacy payment systems come with outdated codebases, vendor lock-in, limited documentation, mission-critical workflows that cannot fail, among other challenges. Our structured approach allows us to preserve business continuity, ensure full compliance, and deliver a scalable, future-ready payment environment.

No problem—we’ll help you decide. Our experienced team evaluates your business model, transaction volumes, and customer and compliance needs to recommend the most effective payment solution.

Fill out our contact form. We’ll schedule a short discovery call to get acquainted, understand your challenges, and outline the next steps.

Can’t find the answer you are looking for?

Contact us and we will get in touch with you shortly.

Our team would love to hear from you.

Fill out the form, and we’ve got you covered.

What happens next?

San Diego, California

4445 Eastgate Mall, Suite 200

92121, 1-800-288-9659

San Francisco, California

50 California St #1500

94111, 1-800-288-9659

Pittsburgh, Pennsylvania

One Oxford Centre, 500 Grant St Suite 2900

15219, 1-800-288-9659

Durham, North Carolina

RTP Meridian, 2530 Meridian Pkwy Suite 300

27713, 1-800-288-9659

San Jose, Costa Rica

C. 118B, Trejos Montealegre

10203, 1-800-288-9659