Contact us

Our team would love to hear from you.

To better understand how AI impacts stock trading, in this article, we will examine its role in the industry, outline the benefits and challenges of the technology for investors, and explore how AI is used in practice.

AI trading refers to buying and selling shares using computer algorithms that simulate human intelligence. AI also encompasses machine learning (ML) and deep learning (DL), technologies that learn from input data and make predictions. In stock trading, these models assist in decision-making by analyzing vast amounts of data, such as historical data, real-time data, market trends, technical indicators, and other information.

The role of AI in stock trading is becoming increasingly important, with technological advancements giving investors new opportunities for faster and more accurate decision-making. AI and related technologies enable the automation of trading processes and provide an ongoing competitive advantage.

The capability of AI models to analyze vast datasets inaccessible to humans and generate accurate insights provides traders with the opportunity to develop more sophisticated strategies. This increases the likelihood of success compared to traditional trading methods, which rely on human intuition and emotions.

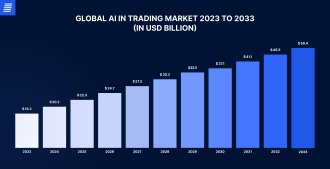

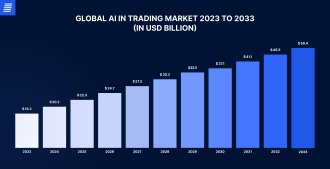

In 2023, the global use of AI in the trading market reached USD 18.2 billion and is expected to reach USD 50.4 billion by 2033. AI technology is becoming more popular among stock traders, facilitating their buying and selling decisions and supporting investing strategies for fintech applications.

Source: market.us

Integrating AI into stock market trading offers numerous benefits that investors can leverage.

AI models are designed to process and analyze vast amounts of data flawlessly and without human assistance. They can also automate some processes, including research, analysis, trade execution, and trading strategy development. This helps save resources and time for other activities and allows investors to focus on strategic decision-making.

When it comes to analyzing vast amounts of data and producing insights from it, AI can perform these tasks quickly and accurately, exceeding human capabilities. AI can also find hidden patterns in data and use them to make detailed forecasts.

AI-powered integrated risk management systems provide insights into potential risks and abnormal market occurrences, analyze different scenarios, and predict their outcomes. This information can help traders make prompt decisions and protect their investments.

In stock trading, humans sometimes rely on their intuition, are influenced by emotions, and make choices based on insufficient data. AI-powered tools reduce the potential for human errors because the technology bases its outputs, conclusions, and strategies solely on the processed and analyzed data.

Despite numerous benefits, there are significant challenges and limitations that should be considered before implementing AI algorithms.

Stock trading involves a significant amount of personal and financial data, so data protection plays a crucial role. Without enhanced security measures, AI trading platforms are subject to cyberattacks and data breaches. To secure sensitive data, it is important to adhere to local and industry data protection standards and requirements.

To obtain reliable and efficient results, AI and ML models must be trained with a focus on the quality and quantity of data. Otherwise, these models produce unreliable outputs that may harm stock trading decisions.

Given the volatility of the market, not all events are easy to predict in stock trading. Since AI models are primarily trained on historical data, they are unable to forecast sudden events and extreme market changes, leading to significant resource losses. Furthermore, AI itself can induce volatility, as AI trading platforms equipped with similar algorithms may exhibit similar and simultaneous responses to changing market conditions.

We developed a desktop trading platform and a first-to-market live trading app for iOS and Android to help City Index users trade effectively, regardless of time and place.

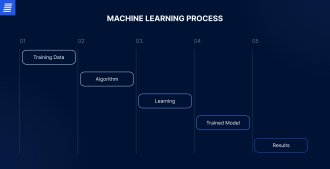

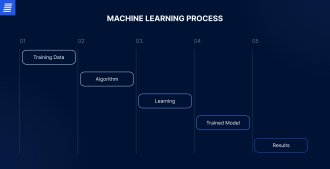

In stock trading, ML models play a significant role by providing insights from enormous financial datasets. These models perform two key functions in stock trading.

ML models are used to identify patterns in data that anticipate market events and movements. In addition to patterns, these models recognize abnormal market activities, helping capitalize on opportunities or mitigate risks.

Based on recognized patterns and anomalies, ML models can make predictions about future market movements, assisting in decision-making and strategy building.

Traders have access to multiple AI-enabled tools and platforms to assist them in their stock trading activities.

AI-powered portfolio management tools assist traders in building a selection of investments and allocating them to meet financial goals and drive profit. Different strategies require different approaches, and AI algorithms can be adapted to any of them. For example, these models can create a stable and low-risk portfolio immune to market volatility, or take a riskier path and seek inexpensive stocks, selling them when the value rises.

AI algorithms can be used in trading platforms to notify users about stocks that meet preprogrammed parameters, helping traders make informed decisions and mitigating risks connected with the buying and selling of assets. AI trading signals streamline the analysis of market trends and dynamics, allowing users to focus on other critical activities.

Strategy builders backed by AI technology assist traders in evaluating and selecting the most suitable investment strategy for a user’s requirements and rules. It can also adjust to changing market conditions, because no strategy is universally effective. It is also crucial to conduct backtests for your AI-generated trading strategy to ensure its effectiveness and refine it as needed.

Trading robots are automated trading systems that use AI algorithms to analyze the market and execute trades following a predetermined trading strategy under certain conditions. These tools quickly adapt to market changes and execute trades continuously, faster, and with greater accuracy than humans, streamlining the process and reducing risks.

AI trading software can perform various functions in stock trading.

The automation of trading activities is achieved by establishing rules and requirements for inputs and outputs of AI-powered models. When these requirements are fulfilled, the necessary activities, such as buying or selling stock, are triggered. This instant response helps avoid the significant resource losses that can occur in traditional trading.

One of the key use cases for AI in trading is predicting changes on the market. AI algorithms rely on historical data to identify trends and patterns and make forecasts. Based on these forecasts, traders can adapt and refine their strategies and make well-informed decisions rather than relying solely on intuition.

AI algorithms can assess market sentiment by analyzing social media, news, and online forum platforms that shape people’s opinions. Sentiment analysis helps determine potential market movements and investor behavior that impacts the market. Based on this information, AI algorithms respond to the sentiment-induced changes and sell or buy stocks accordingly.

AI-enabled performance analysis is used to test and evaluate the efficiency of a trading strategy through backtesting and benchmarking. Backtesting is used to test a strategy, adjusting it and addressing the issues before applying it in practice. Benchmarking allows traders to evaluate their strategies by comparing their performance with the market benchmark (other traders or a certain sector).

Stock trading operations are subject to risks that can lead to significant financial losses. These risks can be mitigated with the help of AI algorithms that identify anomalies, inconsistencies, and unusual patterns or activities and help prevent churning, spoofing, wash trading, and other fraudulent manipulations.

With advancements in AI capabilities, the technology plays an increasingly important role in trading processes. Faster and more accurate AI algorithms will be able to recognize more complex patterns and trends and instantly adjust a strategy to accommodate any market change.

This raises the following question: will AI be able to replace humans? Many traders still rely significantly on human intuition, which AI can’t replace. However, humans can’t compete with AI in processing enormous volumes of information and lack the precision of algorithmic AI solutions. At the same time, AI can’t think creatively or find extraordinary solutions. Thus, by combining human intellect with AI capabilities, traders can achieve maximum profit.

Advanced technologies are infiltrating every industry and area of our lives. Stock trading operations become quicker, more accurate, and more well-informed with the help of AI and related technologies. Despite some challenges, AI has the potential to transform stock trading, enabling smarter investment strategies, improving processes, and assisting in risk management and decision-making. To learn more about AI and its applications in stock trading, contact our team.

AI trading software is a computer program used in stock trading, powered by AI and its subsets, including ML, DL, and NLP. Advanced technologies enable AI software to analyze vast amounts of financial data, identify patterns, make predictions, assist in decision-making, and even buy or sell stock automatically based on predefined conditions.

Developing an AI trading application involves several key steps: business requirement analysis, data collection and preparation, model selection and training, model deployment, testing, and monitoring. However, the development process involves many details that are difficult to navigate without a skillful tech partner by your side. That’s why the first step in the development process should be choosing the right IT vendor.

This is a crucial step toward a powerful AI trading solution. When choosing the right vendor, it’s important to consider the expertise, approach, portfolio, and cost-effectiveness of the IT outsourcing company. Other significant factors include transparency and communication; the software development vendor should be able to collaborate well with the client’s team. Contact our experts to learn about our approach to software product development.

Stock trading involves sensitive personal and financial data, which is subject to regulatory requirements and standards. When using AI in stock trading software, it is important to adhere to these requirements to ensure system reliability and security. One such law that ensures the privacy and security of personal data and is applied in the European Union is the GDPR (General Data Protection Regulation).

Can’t find the answer you are looking for?

Contact us and we will get in touch with you shortly.

Our team would love to hear from you.

Fill out the form, and we’ve got you covered.

What happens next?

San Diego, California

4445 Eastgate Mall, Suite 200

92121, 1-800-288-9659

San Francisco, California

50 California St #1500

94111, 1-800-288-9659

Pittsburgh, Pennsylvania

One Oxford Centre, 500 Grant St Suite 2900

15219, 1-800-288-9659

Durham, North Carolina

RTP Meridian, 2530 Meridian Pkwy Suite 300

27713, 1-800-288-9659

San Jose, Costa Rica

C. 118B, Trejos Montealegre

10203, 1-800-288-9659